Птицын С. Д., Хромова А. В. Разработка плана страхования в сфере инновационного страхования и выбор наилучшего варианта страхования // Скиф. Вопросы студенческой науки. 2019. №9 (37). С. 277-281

Due to the depreciation of the national currency after the events of 2014, the insurance market of the Russian Federation has developed an unfavorable situation for insurance agents [1, 2]. The decrease in solvent demand and the lack of development of the sphere of voluntary insurance provides a reduction in the growth of insurance premiums, as a result of which both insurance market players and consumers suffer because of the inability to afford expensive risk reduction services. Against the background of this situation, a large role is played by new information technologies, which gradually penetrate insurance [3, 4]. In itself, the introduction of modern IT technologies can reduce costs by ensuring the growth of profits of companies that are the first to adopt new technologies. In all the abundance of technology in the digital age, an urgent question arises: «Which option, from the available ones, is the best?» This issue is also typical for the insurance sector, especially within the framework of a limited investment budget and high risks. Therefore, the aim of the work is to evaluate innovative projects aimed at insurance activities, and choose the best of them. The relevance of the work is determined by the possible benefits of the introduction of new technologies, such as: increasing insurance premiums, reducing costs, lowering fees for insurance services, attracting new customers, etc.

Methods

The work is based on the analysis of scientific articles from the RSCI database. Thanks to the verification and critical analysis of the sources, the problems of the insurance market of the Russian Federation are substantiated. From open sources of the Federal State Statistics Service, data are taken that objectively reflect the current position of insurance companies. A search and analysis of promising areas of development of information technologies in the insurance sector was also carried out. Analyzed and applied the methodology of planning capital expenditures in innovation [5, 6]. During the synthesis of the information studied, conclusions are drawn regarding innovative approaches in the insurance industry.

Results

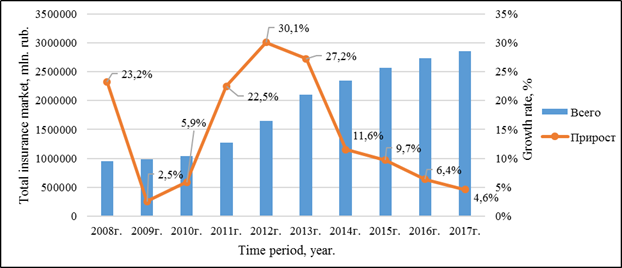

From an analysis of statistics on insurance market indicators over the past 10 years, it is obvious that in the period after 2014, the situation in the insurance market is negative due to the economic crisis and the application of leverage by the world community in the form of sanctions against the Russian Federation. This dynamics is presented below (Figure 1) [7].

From the graph it follows that the volume of premiums in the insurance market in the Russian Federation is growing steadily, but the growth rate of the described market is decreasing year by year. In turn, the increase in insurance premiums is due to the state policy regarding compulsory insurance. At present, compulsory insurance accounts for 63.8% of all insurance services in the market [8].

At the same time, the share of insurance in the GDP of the Russian Federation remains relatively small, at the level of 1.5%, while in developed countries this indicator reaches 7-14% [8].

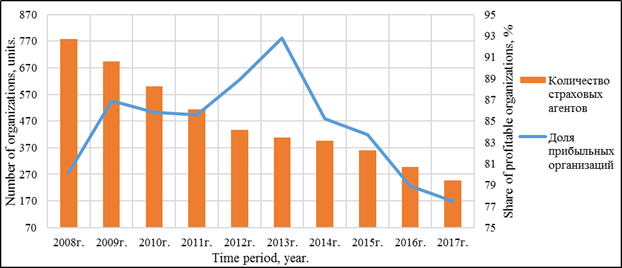

Based on statistical data, the dynamics of changes in the number of players in the insurance market is reflected and the share of profitable organizations in the total number of insurance agents is indicated (Figure 2) [7].

From the graph it is obvious that the number of companies in the insurance market is steadily decreasing, just like the share of profitable companies in the total. This means that only large players are able to withstand adverse economic conditions and make a profit.

A possible way to overcome the crisis may be the introduction of innovative approaches to the services of insurance organizations. At the moment, the most promising of them are [9, 10]:

1. Smart car insurance

2. Smart life insurance

3. Insurance of smart homes.

Figure 4. Dynamics of changes in the insurance premium and the growth rate of the insurance market of the Russian Federation

Figure 5. Percentage of profitable companies relative to all existing insurance companies